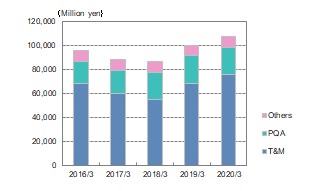

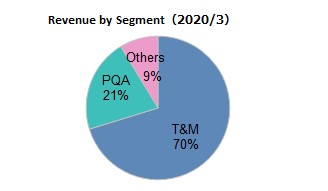

1) Revenue by Segment

(Millions of yen)

|

2016/3 |

2017/3 |

2018/3 |

2019/3 |

2020/3 |

| Test and Measurement |

67,729 |

59,333 |

54,433 |

68,168 |

75,165 |

| Change % |

-7.8% |

-12.4% |

-8.3% |

25.2% |

10.3% |

| PQA |

18,891 |

19,588 |

22,549 |

23,074 |

22,575 |

| Change % |

16.6% |

3.7% |

15.1% |

2.3% |

-2.2% |

| Others |

8,910 |

8,716 |

8,984 |

8,416 |

9,282 |

| Change % |

-3.1% |

-2.2% |

3.1% |

-6.3% |

10.3% |

| Total |

95,532 |

87,638 |

85,967 |

99,659 |

107,023 |

| Change % |

-3.3% |

-8.3% |

-1.9% |

15.9% |

7.4% |

(*) The name "PQA" has been changed from "Industrial Automation" since April 1, 2015 and it is also restated for the past fiscal years. The Information and Communications segment has been included in "Others" since April 1, 2012. Numbers for FY2011 have also been retrospectively presented in "Others".

2) Operating Profit by Segment

(Millions of yen)

|

2016/3 |

2017/3 |

2018/3 |

2019/3 |

2020/3 |

| Test and Measurement |

4,706 |

2,130 |

2,147 |

9,413 |

15,148 |

| Change % |

-47.4% |

-54.7% |

0.8% |

338.3% |

60.9% |

| PQA |

1,194 |

1,302 |

1,969 |

1,609 |

1,287 |

| Change % |

45.0% |

9.0% |

51.2% |

-18.3% |

-20.0% |

| Others |

575 |

992 |

1,458 |

1,145 |

1,900 |

| Change % |

-70.7% |

72.5% |

47.0% |

-21.5% |

65.9% |

| Adjustment |

-578 |

-190 |

-663 |

-921 |

-921 |

| Change % |

- |

- |

- |

- |

- |

| Total |

5,897 |

4,234 |

4,912 |

11,246 |

17,413 |

| Change % |

-45.8% |

-28.2% |

16.0% |

128.9% |

54.8% |